XRP is a crypto currency created by Ripple Labs that utilizes a public ledger called XRP Ledger to facilitate quick and inexpensive transactions. Unlike Bitcoin, which was arguably a project intended as a peer-to-peer payment system, XRP was made for banks and other financial institutions. Its goal? To fundamentally change the way value is exchanged across borders.

Key Features of XRP Coin:

XRP Coin’s unique features set it apart in the crowded cryptocurrency market, making it a powerful digital payment solution for investors and businesses. Here are the key prominent functions of XRP:

Value and Stability “by Design“:

XRP is engineered to bow to a stable and predictable transaction process compared to several other cryptocurrencies that operate on significant volatility. Because of this focus on stability, XRP works well for organizations and financial institutions searching for a stable, reliable digital cash payment method.

Rapid Transaction Speed:

XRP offers real-time transaction processing, allowing transactions to be completed in 3–5 seconds on average. For users seeking efficiency in their global transfers, this speed represents a notable competitive advantage.

Scalable for Enterprise Needs:

XRP boasts a high degree of scalability, up to 1,500 transactions per second, making it ideally suited for large-scale enterprises and financial service providers.

Low Transaction Costs:

XRP has one of the lowest transaction fee structures in the cryptocurrency world, making it ideal for businesses and consumers that conduct large numbers of transactions daily.

Decentralized and Secure:

XRP is a cryptocurrency that offers decentralization built on robust blockchain technology. It brings transparency and increased security without the need for intermediaries.

Ripple Net Integration:

XPR functions without issues during Ripple Net, a payment network that operates worldwide and enables currency exchanges on simple terms for companies.

Regarding predictability, speed, scalability, and affordability, XRP Coin is built to meet future demands.

What is crypto currency?

Cryptocurrency is a form of digital or virtual currency that relies on cryptography (encryption to protect information) to secure transactions. Unlike a dollar or euro, for example, cryptocurrency is decentralized, meaning it isn’t controlled by any central authority like a government or bank.

Bitcoin is the most popular, but there are other cryptocurrencies, like Ethereum, Ripple(XRP), Litecoin, etc. Cryptocurrencies use blockchain, a distributed ledger technology that stores transaction data on computers across a network. Doing so makes it open to view and virtually unwieldy to corrupt.

Key characteristics of cryptocurrencies are:

Rule 1 — Decentralization: No single governing body (that is to say, no government or central bank) controls it.

Anonymity and Privacy: When possible, anonymity in transactions, though not private.

Security: It utilized blockchain technology and cryptographic techniques to secure the transactions.

Universal Accessibility: You don’t need a bank to send or receive cryptocurrencies anywhere in the world.

Volatility: Cryptocurrencies can change their value in a short time.

Cryptocurrency can be used as an investment, to purchase goods and services, and to send money around the world. Their value, though, can be highly volatile, and in several countries, they are subject to regulatory scrutiny.

What is XRP Coin?

Before we get into predictions, we should talk about what XRP is and how it operates. XRP is the native cryptocurrency of Ripple, a company that specializes in providing rapid, secure and low-cost international payments. XRP is different from other cryptocurrencies like Bitcoin and Ethereum as it is not mined. Instead, it utilizes a consensus model called the RippleNet that enables quicker transactions than traditional blockchain technologies. XRP has gained traction due to its partnerships with major financial institutions and its potential to disrupt traditional banking systems.

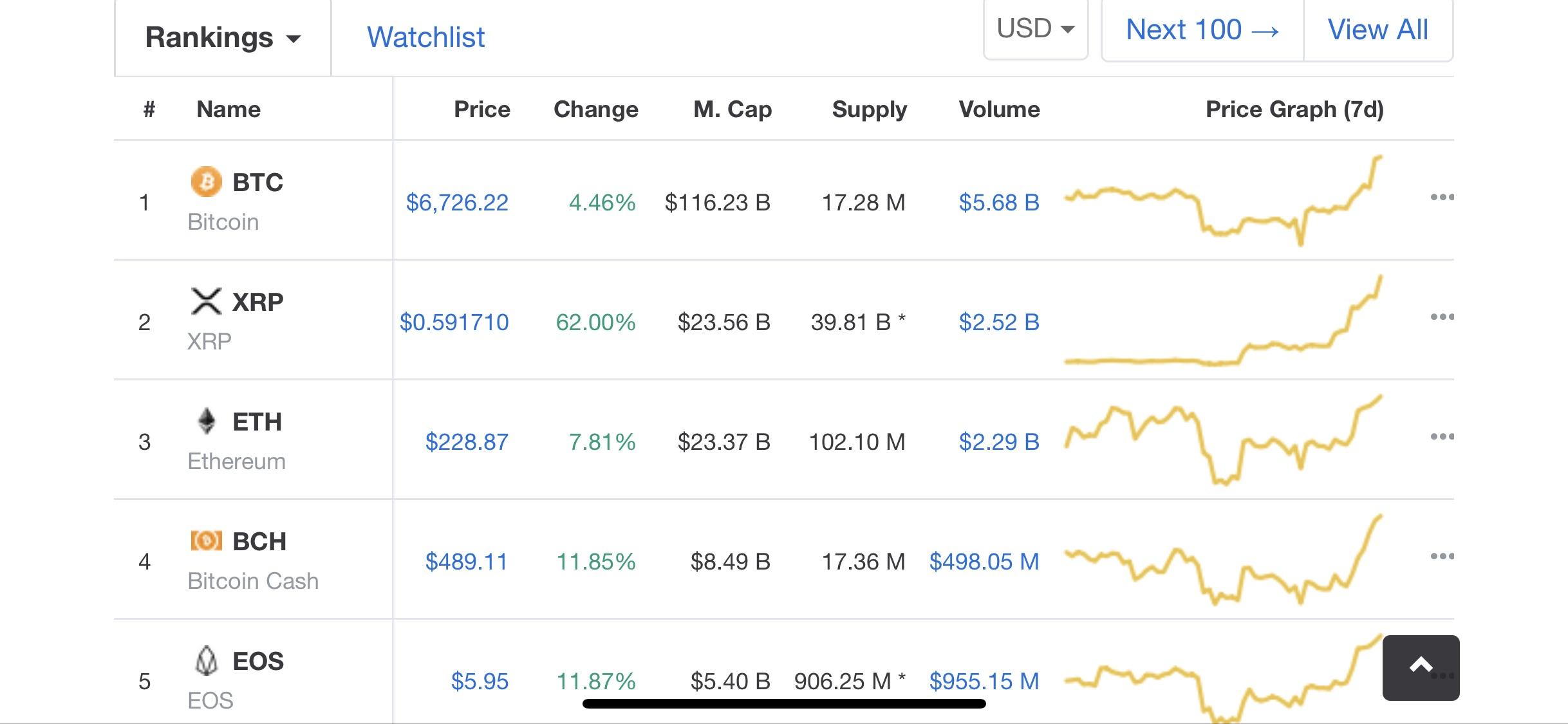

XRP in the Current Market:

XRP is facing some challenges. In 2020, the US Securities and Exchange Commission (SEC) sued Ripple Labs and its executives, alleging that XRP was an unregistered security. Moving on, this legal battle has been a crucial factor influencing the price of XRP due to fears regarding its viability in the US market. Nonetheless, despite the lawsuit and the turbulence within the market, XRP remains a top-tier cryptocurrency, with Ripple continuing to expand its collection of partnerships.

What XRP Might Be Capable Of In 2025

Several key things could impact XRP looking into 2025 and beyond.

Regulatory Clarity

After all, one of the biggest challenges for XRP has been the ongoing legal battle with the SEC. However, there is a growing feeling that the regulation of the cryptocurrency space may soon become apparent. A decision turning out in Ripple’s favor or a broader regulatory framework could unleash a tsunami of demand, especially for XRP in the USA.

Many investors and financial institutions are looking for more precise guidelines, so once things are set in stone, XRP will likely go through a price round since more institutions will be confident to use it. In particular, regulatory clarity in the major markets, such as the US and Europe, will be necessary for the mainstream adoption of XRP.

Increased Collaborations with Financial Institutions

Ripple Labs has partnered with several financial institutions, including Santander, American Express, and PNC. Such partnerships are oriented towards developing cross-border payment systems, which is one of the primary use cases for XRP.

Ripple will likely have a much more extensive network by 2025, with additional banks and partners around the globe using XRP for cross-border payments. We expect more adoption of these blockchain software in the financial sector, so XRP, positioned as a low-cost and fast payment software, will become more attractive.

RippleNet and ODL Remain on the Uptrend

Ripple’s On-Demand Liquidity (ODL) solution, utilizing XRP as a bridge, has transformed payments across borders. Ripple wants to provide an alternative to the old method of transferring money across borders, which is slow and often expensive. By using a satellite link, the ODL system eliminates the need for pre-funded accounts, thus making the money transfer process more efficient and cost-effective.

2025 will see XRP be an essential player in the international payments networks, while RippleNet is here to stay. As demand for faster and cheaper remittances grows and ODL continues to succeed, so will the value of XRP.

More Institutional Buy-In

Institutional adoption shall grow as cryptocurrencies take a mainstream approach. The use case of XRP in enabling cross-border payments leaves it optimistic to catch along with this trend. Specifically, the adoption of XRP by central banks and major financial institutions will pave the way for their use of XRP for payment settlement, and we may also see partnerships between Ripple and banking entities.

Ripple’s enterprise-focused solutions can also appeal to these institutions as it offers a secure and scalable platform designed for global financial transactions. This surge in institutional adoption could potentially bring significant implications for the value of XRP and its long-term positioning within the financial landscape.

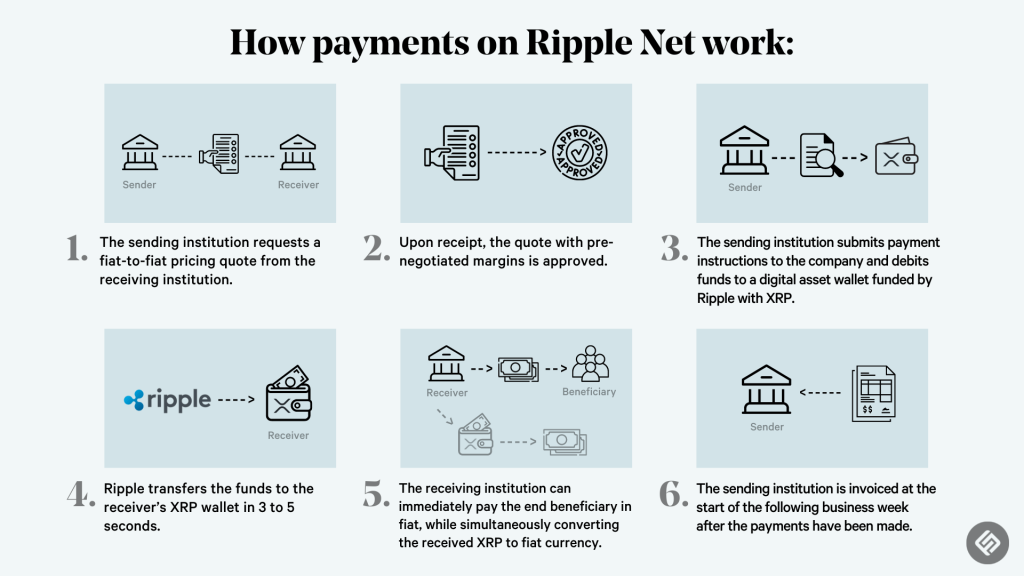

How Does XRP Work?

XRP operates on RippleNet, a platform banks, payment providers, and other financial institutions use to complete cross-border transactions. Without a centralized clearinghouse, RippleNet enables near-instant transfers of different fiat currencies (like USD, EUR, JPY, etc.).

Here’s a breakdown of how XRP works, step by step:

Transaction Request: A bank or financial institution issues a transaction request through RippleNet.

Conversion to XRP: Either the sender’s fiat currency (i.e., USD) is directly converted to XRP.

Cross-Border Transfer: The XRP is moved to the recipient’s bank over the Ripple network.

Redemption into Fiat: Upon arrival, the XRP is redeemed for the recipient’s local currency.

This method accepts immediate settlement, significantly reducing the time and costs of conventional global cash transfers.

Consensus Mechanism

Ripple uses a proprietary consensus model called the RippleNet Consensus Algorithm, unlike many other cryptocurrencies. Rather than using proof-of-work (as Bitcoin does) or proof-of-stake (Ethereum does), Ripple depends on a network of independent validators to verify transactions. The validators perform not mining, which creates new XRP coins, but to verify transactions and maintain the network’s integrity.

The Role of XRP in the Ripple Ecosystem:

XRP has been was adopted in the Ripple Ecosystem and has various roles:

Cross Border Payments Liquidity Provider for Cross Border Payments

XRP serves as a bridge currency for cross-border transactions. Assume a bank in the United States wants to send funds to a bank in Mexico; instead of wiring dollars directly, the bank first converts dollars into XRP. After that, XRP goes to the Mexican bank and changes into pesos. This reduces pre-funded accounts for each country and increases liquidity.

Transaction Fee:

XRP also pays transaction fees on the Ripple Network. These costs are very low compared to traditional financial systems, so XRP is an appealing option for high-volume transfers.

Deflationary Supply:

QRipple employs a distinctive method: It ” burns” part of the XRP in every transaction, which gradually decreases the total supply. This deflationary feature aims to maintain XRP’s scarcity and drive retention value compared to inflationary rates.

XRP Use Cases:

XRP is predominantly used for cross-border payments, but its fungibility does allow for other potential use cases:

Finance and Financial Institutions:

Ripple partners with hundreds of banks and financial institutions worldwide, including Santander, American Express, and PNC. The use RippleNet and XRP to make international payments faster and more efficient.

Remittances:

People worldwide send remittances to family members and friends in other countries. Traditional remittances take a long and are costly. This is where XRP comes into play, facilitating rapid and inexpensive money transfers and transforming the remittance experience for people worldwide.

Liquidity on Demand:

One of the most unique features of XRP is its capacity to serve as a liquidity bridge. Traditional financial systems would require a company to maintain a pre-funded account in each country it does business in, requiring hold time to convert currency, whereas using a liquid asset like XRP can be transferrable within seconds and converted into any currency. It aids in improving liquidity and lowering operational cost.

XRP vs. Bitcoin: Key Differences:

While both XRP and Bitcoin are classified as cryptocurrencies, they exhibit substantial differences in their underlying technology, intended purpose, and practical applications. Some crucial distinctions:

| Feature | XRP | Bitcoin |

|---|

| Purpose | Cross-border payments and liquidity | Decentralized digital currency, store of value |

| Consensus Mechanism | RippleNet Consensus Algorithm (no mining) | Proof-of-Work (mining) |

| Transaction Speed | 3-5 seconds | 10 minutes (on average) |

| Transaction Fees | Less than $0.01 | Varies depending on network congestion |

| Scalability | 1,500 TPS | 7 TPS |

XRP is specifically engineered to improve the efficiency of international payment systems, whereas Bitcoin serves primarily as a decentralized substitute for conventional currency.

XRP Price Prediction: What to Look Forward to for 2025

XRP price in 2025 is an issue of much more interest among cryptocurrency lovers and investors. Although forecasts for where any cryptocurrency will be in the future are speculative and maneuverable to a wide range of domestic conditions, we can analyze a few key aspects that could impact the cost of XRP by 2025. These include regulatory changes, mass adoption, technological innovation, and the crypto environment.

Important Factors Driving Price of XRP in 2025:

Regulatory Clarity

One of the primary factors driving XRP’s price and one of the most significant matters affecting XRP prices is an ongoing lawsuit between Ripple Labs and the US Securities and Exchange Commission (SEC). The reasons stated for winning or losing this Case could determine the future of XRP.

However, if Ripple wins and XRP is not a security, we could see wider institutional adoption and increased listing of XRP on exchanges, which should, in turn, drive prices higher.

On the other hand, an SEC victory in the Case could impose heavy headwinds on XRP, such as marching orders to US exchanges to delist the token, which could weigh on price.

Expanded Use by Financial Institutions

Global banks like Santander, PNC, American Express, Standard Chartered, and others have adopted Ripple. This adoption is a keystone in the XRP value proposition, as the coin aims to enable cross-border payments for a low fee and with high velocity.

Ripple — XPRU Ripple — On October 18, the cryptocurrency market saw a sharp correction after months of bullish action. If this continues, it would create more demand for XRP as a liquidity bridge, potentially driving its price higher.

Remittances and Payments Solutions sarad@wefox.com2023-10-06T09:22:12+00:00

Remittances comprise a large part of cross-border financial flows. Millions of people send money home to their families worldwide, and the demand for fast and cost-effective solutions is growing.

With the increased integration of XRP into the global payments infrastructure, its use has the potential for exponential growth. XRP may become increasingly adopted by more countries and businesses for remittance services, which can increase its value owing to the increased transaction volume and liquidity.

Technology Developments and Network Enhancements

When it comes to technology, Ripple Labs has always caught every beat. Improvements to the existing RippleNet network – or the introduction of new features or ongoing updates – bolster the functionality and appeal of XRP, as would enhancements to the XRP Ledger, like greater scalability or increased transaction validation efficiency.

Unlocking new use cases with Decentralized Finance (DeFi) applications on the XRP Ledger could potentially open up further use cases like lending, borrowing, and staking, which may increase demand for XRP.

Macro-Economic Factors & Market Sentiment

Cryptocurrency markets are very volatile and also affected by the broader macroeconomic environment. For example, global inflation, interest rates, and the regulatory environment across major markets (US, EU, and Asia) could influence XRP price levels.

Moreover, if other big cryptocurrencies (such as Bitcoin or Ethereum) continue to gain traction, XRP could benefit from increased interest in digital assets overall.

Competition from Other Blockchain Projects

XRP Is Not Alone: Cross-Border Payments Race Heats Up Stellar (XLM) has ambitions similar to Ripple’s and could be one of XRP’s biggest competitors. Should Stellar or another fringe project attain a substantial market share within the same niche, this could also dent XRP’s dominance and further dent its price.

Nonetheless, XRP has a strong lead in the fight over who will rule the cross-border payment race thanks to Ripple’s impregnable institutional partnerships.

Analyst Perspectives on XRP Price Forecasts for 2025

Bullish Case: $10 — USD 15

Therefore, XRP could benefit from significant price appreciation if Ripple Labs can beat the SEC in court and grow its network of financial partners.

XRP price prediction: 2025 speculative analysis In a bull scenario, XRP could hit $10 – USD 15 by 2025 in the speculative Scenario where institutional adoption and real-life utility drive demand.

There could also be a growing price action of XRP due to its deflationary mechanisms (tokens being “burned” over time) and increasing use of XRP as a liquidity bridge, which would drive up prices on increased demand and lessened supply.

Most Likely Scenario: $5-USD 7

However, in a more conservative estimate, XRP may gradually increase to between $5 and $7 USD in 2025. Of course, this assumes that the SEC’s Case (or lack thereof) doesn’t destroy XRP’s marketability and that utility continues to grow slowly but constantly.

Given this potential and Ripple’s global expansion strategy, continuous partnerships in the financial sector may certainly see XRP price push higher steadily, but only with challenges from competitors and regulatory hurdles.

Bearish Scenario: $1 – USD 2

In a bearish case, Ripple with XRP could fail to sustain its current price if it can’t overcome the SEC case or if RippleNet fails to see mass adoption.

In such a scenario, XRP may witness price stagnation or even drop to the $1 – $2 USD range, particularly if the broader cryptocurrency space experiences a significant downward trend or if regulatory headwinds keep emerging.

Is $10 Realty For XRP by 2025?

XRP’s future will be determined mainly by regulatory decisions, institutional adoption, and the growth of Ripple’s network. Although we cannot predict the actual price of XRP for 2025, certain aspects are already in place that could increase the price, such as rising global use cases for cross-border payments, continued growth in partnerships, and a favorable regulatory environment.

Traders will need to continue monitoring Ripple’s court fight with the SEC, the continued adoption of RippleNet among banks and other financial institutions, and overall market sentiment in the crypto sphere. Although XRP may have tremendous potential to grow, it is worth noting that cryptocurrency investments are extremely volatile, and thus, caution should always be exercised when making investment decisions.

While XRP has significant room for growth in the coming years, its value in 2025 will likely be shaped by the resolution of regulatory challenges, a rise in institutional use, and prevailing trends in the digital asset ecosystem.

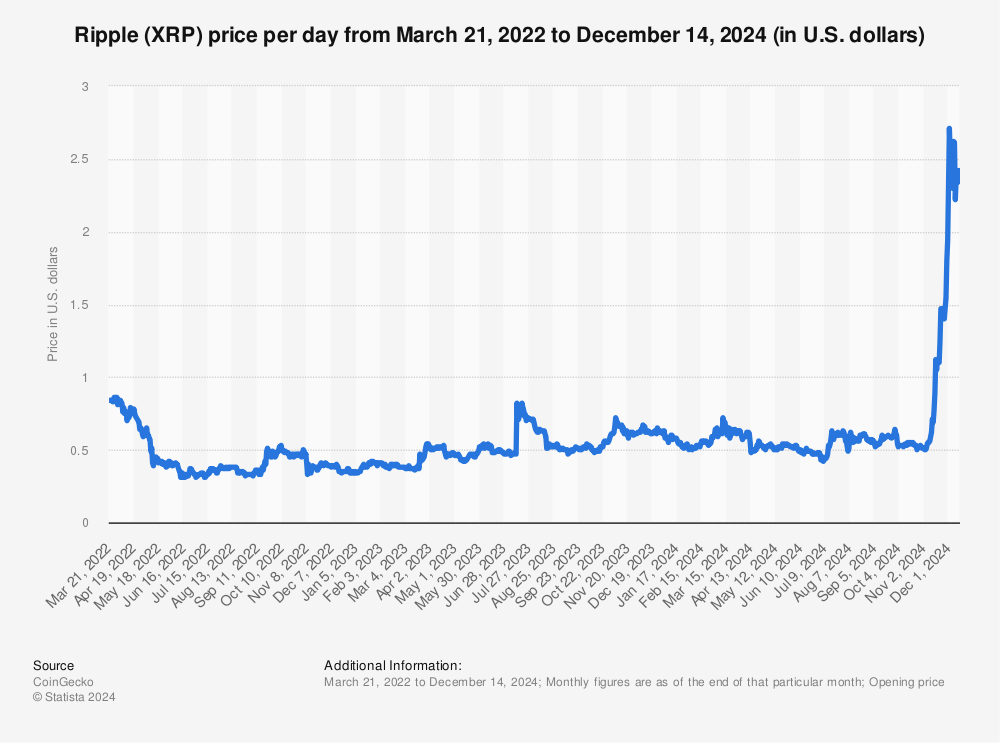

XRP Price Trends: A Historical Overview:

XRP: The First Five Years (2012 – 2017)

XRP: The Launch and Initial Price

Ripple was launched in 2012 by Ripple Labs (founded by Chris Larsen and Jed McCaleb) to improve global payments, especially cross-border transactions287.

When it first came out, XRP had very little market visibility, and it traded at less than $0.01 USD for most of its first few years. As noted, this market was very new, and the understanding of what Ripple was bringing to financial institutions was still in its infancy.

Rise in 2017:

The price of XRP surged massively in 2017, fueled mainly by the crypto boom that year. It was the year that Bitcoin reached a peak of nearly 20,000, and the actual crypto asset industry exploded.

XRP peaked with the market, reaching an all-time high of USD 3.84 in January 2018. This rally was partly driven by growing speculation regarding Ripple’s collaboration with prominent financial organizations and XRP’s ability to transform cross-border payment processes.

But XRP, alongside countless other cryptos, plunged into a protracted bear market after peaking in January 2018.

The Bear Market (2018 – 2020)

Price Correction (2018):

Following the euphoric all-time high run of 2017, the price of XRP began its correction in 2018. Subsequent bear markets caused prices to crash, and by the end of 2018, XRP was worth less than USD 0.30.

It was a time of regulatory uncertainty, general market malaise, and skepticism around Ripple’s ability to expand its tech to the global payments ecosystem.

Slow Recovery (2019 – 2020):

XRP saw little growth in 2019 through many of Ripple’s partnerships with other financial institutions and has tried to impose itself as a solution for cross-border payments.

XRP’s price mostly moved between $0.25 – USD 0.50 for the majority of 2019 and 2020 as it continued to battle to escape the stagnant phase of the broader cryptocurrency market.

Over this stretch, Ripple dealt with growing regulatory scrutiny, especially from the U.S. Securities and Exchange Commission (SEC) — a factor that would significantly determine XRP’s price path.

The SEC Lawsuit and the Volatility of XRP (2020 – 2022)

The SEC Lawsuit (2020):

In December 2020, the SEC sued Ripple Labs, accusing the company of engaging in an unregistered securities offering by selling XRP to retail investors.

This news rocked the cryptocurrency market. Several exchanges, such as Coinbase and Binance, either delisted XRP or paused token trading. The token saw a drastic plunge following the news, with XRP giving up much of its market momentum.

The uncertainty surrounding the lawsuit resulted in XRP’s price drop to as low as USD 0.17 from USD 0.60 in early December 2020.

Volatility and Legal Drama (2021 – 2022)

In 2021, XRP prices were volatile between $0.40 and USD 1.80, as Ripple was contesting the case. Although the lawsuit hasn’t been resolved, XRP experienced several price spikes, driven mainly by the general uptrend of the crypto market and increased interest in decentralized finance (DeFi) and blockchain-based financial systems.

Investors remained cautious due to the ongoing lawsuit with the SEC, which has cast doubt over the future of XRP’s price movement. XRP did see some Q4 2021 support after a decision that one ruling was in Ripple’s favor, which stated that the SEC needed to produce more documents linked to its internal communications. This offered some hope that Ripple could win the case, resulting in a temporary boost in the price of XRP.

Rebound and Market Resilience (2023 – 2024)

Legal Clarity and Limited Victory (2023):

In July 2023, Ripple achieved a major partial win in the long-running litigation with the SEC. This means that XRP, when sold on exchanges, is not considered a security, which led to XRP soaring over 50% in a matter of hours.

The decision sparked optimism in the market, and XRP started regaining its lost ground. But by the end of 2023, the price of XRP skyrocketed to $1.50 – $2.00 USD, with renewed interest from retail and institutional investors alike.

XNOR: Positive news around the legal case, continued expansion of RippleNet, and growing institutional adoption have started to bring interest back to XRP.

Price Consolidation in 2024:

In 2024, XRP found itself moving in a tighter range, fluctuating between $0.80 and $1.50 USD when the wider cryptocurrency market faced regulatory headwinds and the impacts of the global economy.

Ripple also continued to expand its partnerships—particularly in the Asia-Pacific region—and the company’s push into stablecoins and tokenization further supported the outlook for XRP.

However, in recent months, XRP has faced challenges, particularly from competitors like Stellar (XLM) and other blockchain-based payment solutions.

Factors That Drive XRP Price Fluctuations:

Legal and Regulatory Developments

Regulatory clarity is one of the most impactful elements of XRP’s price. The results of Ripple’s litigation with the SEC, in particular, have created massive price fluctuations. A favorable ruling or positive regulatory environment would push the price, and a hostile regulatory environment or lawsuits would see steep declines.

Institutional Adoption and Collaboration

Significant price movements of XRP are mainly attributed to its collaborations with well-known financial institutions like Santander, PNC, and American Express. The higher the number of institutions adopting RippleNet and using XRP for cross-border payments, the higher the demand for the coin, which could drive the price up.

The growth of cross-border payments and remittance services is a massive part of Ripple’s strategy, and a corresponding growth in these areas means a corresponding increase in XRP’s value.

What Are Investors Expecting But Also Speculating

The price of XRP is very sensitive to market sentiment—the collective mood of the cryptocurrency market, which can shift from extreme optimism to pessimism. XRP moves along upward trends in bull markets. As with any coin, it is subjected to the same pressures during bear markets.

XRP’s price is also heavily influenced by speculative trading. Traders frequently purchase and sell XRP based on news, rumors, and perceived market opportunities, leading to sizeable short-term price movements.

Technological Developments

Positive developments in Ripple’s tech improvements, like the release of new XRP Ledger upgrades or growth into DeFi and NFTs, can positively influence the price of XRP.

Additionally, partnerships with fintechs, banks, and payment processors indicate growth in XRP’s adoption, which may create demand.

What Lies Ahead for XRP?

Projections and Outlook for 2024 – 2025

Legal Resolution: A favorable settlement in the ongoing legal fight against the SEC can lead to a massive bull run of XRP as investor confidence and institutional adoption increase.

Institutional Adoption: Ripple’s consistent growth in financial clients hiked XRP’s price, particularly in the areas of cross-border payments and remittance services

Global Adoption: As economic conditions worldwide change and the implementation of Central Bank Digital Currencies (CBDCs) and blockchain-based payment systems gain momentum, XRP’s demand as a bridge currency could surge, further boosting its price.

Long-Term Outlook (2025 and Beyond)

As Ripple’s vision of a global digital payments network finds greater adoption and XRP becomes increasingly entwined in international finance, the cryptocurrency can see persistent price appreciation.

Moreover, should Ripple successfully tokenize tangible world assets and penetrate new markets like stablecoins and decentralized finance (DeFi), XRP could have a significant part in that, aiding in pushing its price up.

Conclusion:

The price movements of XRP have captured a range of challenges including regulatory issues, technological developments, market sentiment, and institutional adoption. It has seen rapid growth in some periods but has also had its share of volatility and uncertainty, mainly due to the SEC suit. Nonetheless, Ripple’s recent endeavors to expand its network and the eventual likelihood of greater legal clarity means that XRP could increasingly become a force to be reckoned with from a price standpoint in the coming years.

As ever, cryptocurrency investments come with risks, and while XRP has a lot of potential, its future price trends will be heavily determined by factors beyond anyone’s.